How to interpret financial analysis ratios

A big part of conducting fundamental analysis of shares is calculating and interpreting financial analysis ratios.

Some ratios are shown in the pages of the Financial Times, others you will have to calculate yourself by reading the company accounts. Here is an explanation of the most popular ratios and how they are used.

Related page

- Guide to stock market investing

Guide on how to approach stock market investing

The Price-Earnings Ratio

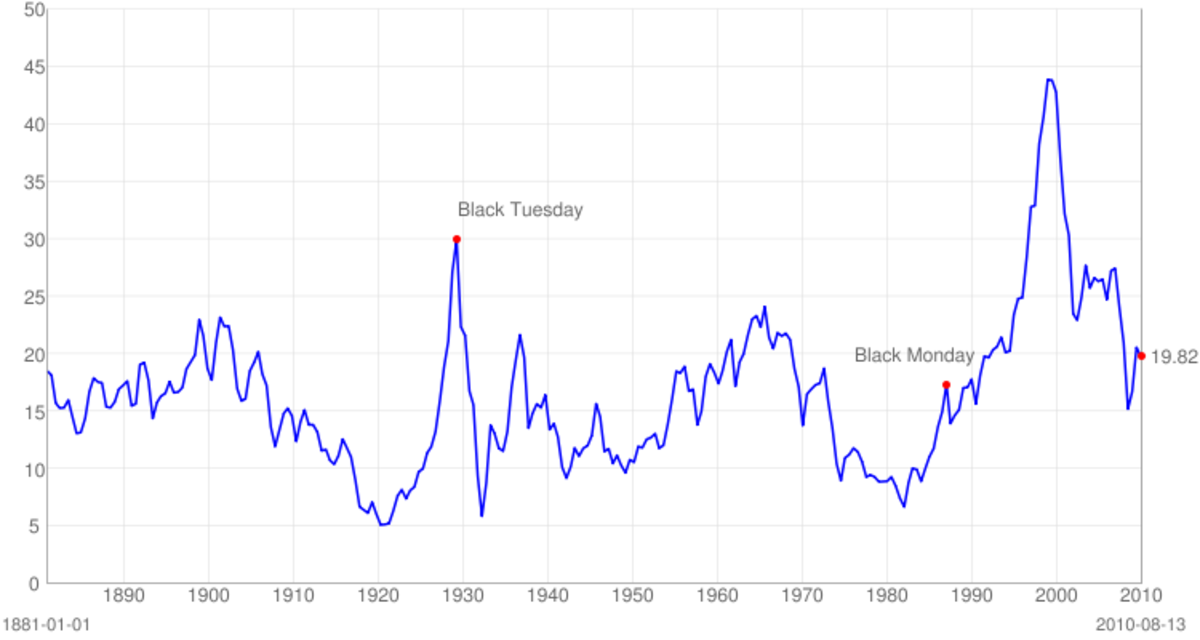

The Price-Earnings ratio (or P/E ratio) is the Share Price divided by the Earnings Per Share. The Earnings Per Share is the Net Profits after tax divided by the total number of shares the company has issued (to find this in the accounts, go to the Profit and Loss account - it is usually shown below the Net Profits After Tax). Because this is based on the last year's accounts, it is usually known as the historic Price/Earnings ratio (some financial analysts calculate the prospective P/E ratio based on what they think the company's future profits will be). Most newspapers print the historic P/E ratio next to the share price.

The P/E ratios for most shares are in the mid teens. To interpret the ratio, first check the P/E ratio's of other companies in the same sector, and look for the share you are examining to be in the same ball-park - if it is unusually high or low compared to the rest of the sector, you need to investigate further.

If a company has a low P/E ratio, but their earnings are rising year on year, then investigate to see if there is a reason that the share is undervalued. It might be that you've found a bargain, but it might be that the market is marking the share down because they are worried about something, perhaps a piece of news that has come out. If the P/E ratio is in the thirties, the share is very expensive. If you own the share, check the company's earnings potential. In order to sustain the share price they will need to make large increases in profit. If you think this is unlikely, sell.

The Dividend Yield

This is the dividend per share divided by the share price. Not all companies pay dividends, but it is a good sign if they do, as the dividend comes out of the profits after tax - which means that companies that pay dividends are invariably profitable. Further, once they start paying dividends companies will do anything to maintain it, knowing that their shares will get dumped by instituitional investors if they cut the dividend. Thus the dividend payment acts as a majpr discipline on companies.

If you are investing for income, the dividend yield becomes important as you will get a stream of income from a high yielding company that manages to pay their dividend year after year.

The Profit Margin

The Profit Margin: This is the Profits After Tax divided by the Turnover (Sales) figure, and then multiplied by 100 to convert to a percentage. The higher the profit margin the better. When doing your share analysis, calculate the profit margins of the main competitors to see how well the company is doing by comparison - you want a company with a better profit margin than it's competitors. If a company has a profit margin of less than 5%, they are either either be in a very competitive sector with wafer-thin margins or they may be simply doing badly. As a general rule, avoid companies with very low profit margins - small downturns in the economy can push them into making losses.

Gearing Ratio

The Gearing ratio is the Total Debt divided by the Shareholders funds, and then multiplied by 100 to get a percentage. The higher the gearing ratio, the more precarious the company situation is. Total debt includes short-term debt - and in recessions, the companies that go bust are those who can't get their short-term debts rolled over by their banks. Companies with high gearing ratios can get into trouble during recessions when lending criteria suddenly tightens..

Debt to Equity ratio

This ratio looks at the long term debt. Find the long term liabilities in the balance sheet, and divide by the shareholders funds. Compare the ratio to competitors in the sector - if the company you are analysing has a higher debt to equity ratio than it's competitors. You are ideally looking for as low a ratio as possible..

Helpful pages: